defer capital gains tax stocks

One way is to delay selling your stock for a year. 5 hours ago24 of 6730 is 161520 which is the amount the investor would owe in capital gains tax for this stock sale.

It empowers investors to defer capital gains taxes from the sale of stocks bonds private businesses or real estate by reinvesting the proceeds into a qualified opportunity fund QOF within 180.

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

. Residential Indians between 60 to 80 years of age will be exempted from long-term capital gains tax in 2021 if they earn Rs. You can defer paying capital gains tax for your shares only when you got them from a spouse or parent due to death or divorce. Select Popular Legal Forms Packages of Any Category.

First they offer a temporary deferral of taxes on previously earned capital gains if investors place existing assets into Opportunity Funds. As anyone with much investment experience can tell you things dont always. Watch a short video overview here.

The pathway to deferring your capital gains taxes will start with selling your appreciated asset to the trust first which will then sell to the buyer. Plus it generates for you a bigger tax deduction for the full market value of donated shares held more than one year and it results in a larger donation. Can You Defer Capital Gains Tax In Australia.

As the investment is an untaxed gain the taxpayers initial basis in the QOF is zero. The IRS allows the deferral of these gains through December 31 2026 unless the investment in the opportunity zone is sold before that date. There are several ways to defer capital gains taxes on stocks.

You dont include the gain in your income until a change in circumstances causes a CGT event to happen. How to Defer Avoid Paying Capital Gains Tax on Stock Sales 1. As you can see capital.

This allows you to defer paying the tax on the amount of profit you have reaped. Here are 14 of the loopholes the governments gain tax unintentionally incentivizes. The gain is deferred until December 31 2026or to the year when the taxpayer withdraws the QOF assets if that occurs earlier.

An individual will be exempted from paying any tax if their annual income is below a predetermined limit. All Major Categories Covered. How Long Can I Defer Capital Gains Tax.

How to Reduce or Avoid Capital Gains Taxes Turn Your Investment Property into Your Primary Residence. Investors can realize losses to offset. If you live in your property for at least six months once you purchase it you may be exempt from the capital gains tax.

For individuals of 60 years or younger the exempted limit is Rs. Once upon a time you could have deferred capital gains taxes from the sale of that stock through use of a 1031 exchange. Qualified Opportunity Zones can defer or eliminate capital gains tax by utilizing three mechanisms through Opportunity Funds the investment vehicle that invests in Opportunity Zones.

IRC 1400Z-2 allows the deferral of eligible gains when gains are reinvested in a qualified opportunity fund ie an investment vehicle that files either a partnership or corporate federal income tax return and is organized for the purpose of investing in a qualified opportunity zone property within 180 days. The easiest way to limit or avoid the capital gains tax is to. That avoids the capital gains tax completely.

So if your spouse bought 100 shares of ABC stock and then transferred them to you in the divorce neither of you will have to pay capital gains tax on it at that time. Investors who take their capital gains and reinvest them into real estate or businesses located in an opportunity zone can defer or reduce the taxes on these reinvested capital gains. 3 In addition to deferring capital gains tax reinvestments in a.

A promissory note in return. Utilizing losses is the least attractive of all the options in this article since you obviously had. The 10 Percent to 15 Percent Tax Bracket.

Use Capital losses to Offset capital gains. Australian Financial Complaints Authority 1800 931 678. This basis lasts for five years so any funds withdrawn from the QOF in that time are fully taxable.

How Long Can You Defer Capital Gains Tax. Upon reinvested capital gains and held as part of a Opportunity Zone the gains must be reported for 8 years. This is the newest and most complicated as well as controversial way to defer or avoid capital gains taxes.

1 2018 eliminated personal property assets such as stamp collections art and yes your stocks from like-kind exchange treatment. Another option is to invest in a retirement account. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

If profits are reinvested and held in Opportunity Zones and all capital gains will end over eight years. Invest in a securities firm for at least one year and invest in the same stock firm for at least three years then reduce the amount of capital gains tax by 10 and 15. However the Tax Cut and Jobs Act TCJA which took effect on Jan.

You should lower the amount of capital gains tax on investments lasting 5 or 7 years when held for 10 and 15 years respectively. If you are selling Bitcoin or other cryptocurrencies you will transfer the asset to a newly formed exchange account first before the coin is sold to USD.

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Ways To Potentially Defer Capital Gains Tax On Stocks

The Preferential Tax Treatment Of Capital Gains Income Should Be Curbed Not Substantially Expanded Itep

Dividend Tax Rates In 2021 And 2022 The Motley Fool

How To Reduce Capital Gains Tax On Stocks

Tax Deferral How Do Tax Deferred Products Work

Strategies For Investments With Big Embedded Capital Gains

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

What Is The Benefit Of Tax Deferred Growth Great American Insurance

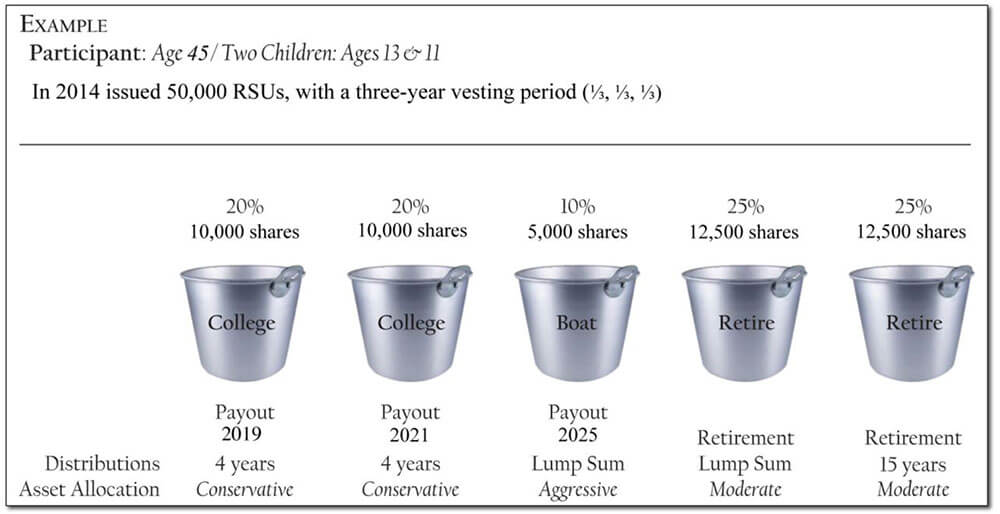

Restricted Stock Units In Nqdc Plans Executive Benefit Solutions

Strategies For Investments With Big Embedded Capital Gains

Ways To Potentially Defer Capital Gains Tax On Stocks

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Strategies For Investments With Big Embedded Capital Gains

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)